Introducing the daft report earlier this year, Gerard O’Neill discussed the possibility that we might become a nation of renters. On the other hand, there is a lot of talk at the moment, particularly from those selling homes such as these guys in Palmerstown, about how it is significantly cheaper to buy than to rent. I thought it would be worth investigating this a little more, because at the end of the day, despite all the crazy economic goings-on of the past three years, people still have to make a decision about where and how to live. Is it cheaper to buy than rent, and if so by how much? How do things look now compared to the boom years and how will things look if house prices and rents continue to fall?

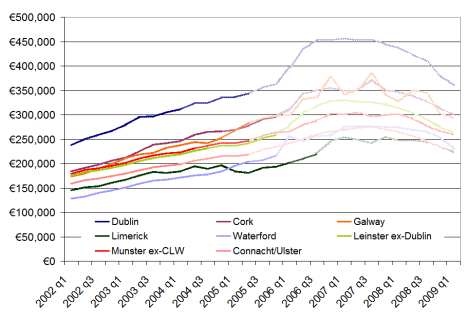

To do this, I had a look at average prices and rents for three-bedroom properties around the country from the start of 2006 on. I wanted to calculate the annual premium for owning your accommodation as opposed to just renting it, bearing in mind mortgage interest relief, prevailing interest rates and changing property values and rents. After all, economic theory would suggest that if you get to own the asset at the end of thirty years of living there, you should pay more than if you don’t.

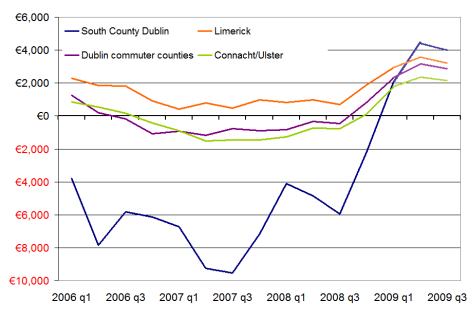

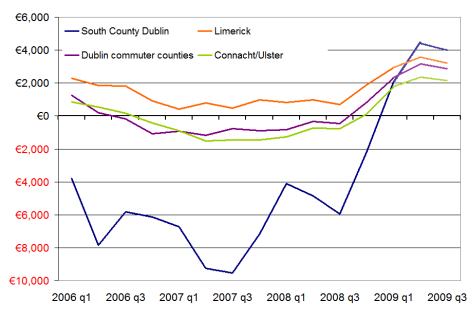

The graph below shows the difference between renting and buying in annual terms for four regions – south County Dublin, Limerick, Dublin’s commuter counties and Connacht/Ulster outside of Galway. It’s calculated for a first-time buyer couple, with mortgage interest relief based on the first year of repayments. I’ve taken ECB+1% as the benchmark interest rate – something which of course may only hold for the first year.

Annual savings for owning rather than renting, 2006-2009

Even with property prices the way they were, it was cheaper to buy your house in 2006 than it was to rent it in everywhere around the country except South County Dublin. Generally, first-time buyers in Dublin could expect to save at least €2,000 over the course of their first year, while elsewhere they could expect to save about €1,000. Only in South County Dublin were first-time buyers actually paying any premium on ownership – in the order of €4,000 over the year for their three-bedroom home.

Sometimes I look back at 2005 and 2006 and wonder what we were all up to. Given those maths, it’s a bit easier to understand again. Of course, things didn’t stay that way. ECB rates started increasing and by mid-2007, potential first-time buyers were faced with the prospect of a premium on ownership in order of €1,000 over the first year – this at a time of uncertainty over capital values. In South County Dublin, the premium on home ownership for the first year was almost €10,000. It should be noted that in a couple of areas, South Dublin city (i.e. all areas with even postcodes), West Dublin and Limerick, it was cheaper to buy than rent – even when interest rates were at their highest. These areas have repeatedly exhibited the highest yields on residential property (about 4% over the past couple of years – high is relative).

Since late 2008, though, as lower interest rates have kicked in, there has been a dramatic swing in the maths back in favour of home-ownership. In late 2008, if you paid the asking price and got ECB+1% for your mortgage, you could expect to save €1,000 in most parts of the country – and more than €3,000 in Limerick or West Dublin. What’s worth noting is that this is at a time of rapidly falling rents as well as house prices. Looking at Q1 figures, that trend is growing with first-time buyers able to save in the region of €3,000 in their first year of ownership. Even in South County Dublin, a household will save money if they buy rather than rent.

How will these figures look in a year’s time? I’ve put in figures marked 2009 Q2 and Q3 to give an indication of how the buy-or-rent decision might look. I’ve assumed another 20% fall in house prices – that’s about a 40% fall from peak to trough. (If that sounds drastic, probably best not to read David McWilliams’ latest comparison of Ireland and Japan.) For rents, I’ve gone for 33% peak-to-trough fall (again, there are those who argue it could be more). In that scenario, buyers would continue be better off than renters in every part of the country. First-time buyers of three-bedroom properties would expect to save anywhere between €1,800 (West Leinster) and €7,000 (Dublin city centre).

To some extent, this is being driven by mortgage interest relief, which is greatest in Year 1. However, Q1 figures indicate that even if there were no mortgage interest relief, there are areas of the country where it is cheaper to buy than rent. And if house prices fall 40% from peak to trough, and rents fall 33%, it will be cheaper to buy than rent, even with no mortgage interest relief, in all areas of the country apart from South County Dublin.

What about the downside? If there are indeed significant swathes of vacant properties around the country that will continue to put pressure on rents for the next 3-5 years, could both rents and house prices halve from their peak values? If that were the case – meaning the typical three-bedroom home in south Dublin city would cost about €900 a month to rent or cost about €275,000 – the maths in favour of buying still look convincing in Dublin but elsewhere it’s a much tougher call. Without mortgage interest relief, homeowners would have to pay around €1,000 a year over what they’d pay to rent.

The tax system as it currently stands certainly strongly favours home ownership. If the government decides that the balance of emphasis when correcting its fiscal black hole should be on raising taxes rather than cutting expenditure, it may abolish mortgage interest relief and bring in a universal residential property tax. This could significantly alter the maths of buying versus renting and bring about the ‘nation of renters’. As it stands, though, even if rents were to halve over the coming year, the premium people pay to actually own their home appears too small for that to happen.

Filed under: 3 Property Market | Tagged: buy or rent, irish economy, irish property market, property, property market, recession, rental market, rents | 16 Comments »